Transforming Oversized and Under-utilized Bank Branches

to Attract New Deposits and Reduce Bank Costs

Digital Disruption has irreversibly transformed the banking landscape

An increase in online banking, and cashless payments have reshaped the financial world, resulting in innovative technologies and new ways of working. It’s exciting to see, and yet tired, drab bank branches don’t seem to reflect new trends.

Inaction Isn’t Passive. It Comes at a Cost.

Banking has never been more complex. Operating costs are rising, foot traffic is falling, and capital efficiency is under the microscope. Amid all this, oversized and underutilized branches often sit unchanged, quietly eroding long-term value.

At first glance, inaction may seem like the safer path. But the real cost is hidden:

- Deposit attrition as outdated branches fail to meet modern customer expectations.

- Idle capital trapped in real estate that could be fueling growth.

- Mounting maintenance and depreciation making future divestment harder.

Concurrently, forward-thinking banks are making bold moves:

- Reducing their physical footprint through targeted sale-leasebacks.

- Refreshing customer-facing space while monetizing the rest.

- Creating vibrant, multi-tenant hubs that attract foot traffic and boost deposits.

Inaction doesn’t preserve value. It drains it. Take control of your real estate strategy and move your bank ahead of the curve.

Ask Yourself

What’s the Cost of Inaction vs. Over Reaction?

Consider these scenarios:

Scenario 1.

Leaving every branch “as is”.

Scenario 2.

Closing the bank branch.

Scenario 3.

Pursuing a strategic sale-leaseback and modernization initiative to reactivate

the business capacity of the building.

Brookline Asset Management’s strategic alternative to this:

Partial sale-leaseback + modernization

THE “LESS IS MORE” STRATEGY

We Don’t Do Things the Way They've Always been Done. We Do Things the Way They Will be Done.

We see no reason for bank branches to be stuck in the past. Brookline Asset Management’s “Less is More” Strategy right-sizes banks, using full and partial sale-leasebacks to give banks the space they need while allowing them to create a long-term partnership with their community and rejuvenating the local economy. In fact, we’re the only company offering partial and full sale-leasebacks, giving our partnering Banks the flexible and adaptive solutions they need.

Here’s how it works:

1. Buy the Portfolio & Right-size the Branch

We work with the bank directly to acquire their bank and credit union branches and assess how much space each bank needs. We then reduce their space accordingly, normally to an average of 60% of the original square footage, across the acquired branch portfolio.

2. Sign Bank Leases

We use full and partial sale-leaseback agreements to create bank and credit union leases for 15+ years, with renewal options.

3. Retrofit & Re-lease to New Third-Party Tenants

We modify the resized bank so that it’s ready for multi-tenant occupancy and lease out the newly retro-fitted space to other tenants, from law offices to dance studios to accountants to nonprofits to developers, engineering firms and construction companies.

4. Repurpose & Revitalize

Instead of a single bank branch, there’s now a thriving, professionally managed business center with multiple tenants, driving more traffic to the heart of your local community.

CASE STUDY

With Our Help, BMO West Bend Increased Deposits by 22% in Five Years.

Key Stats

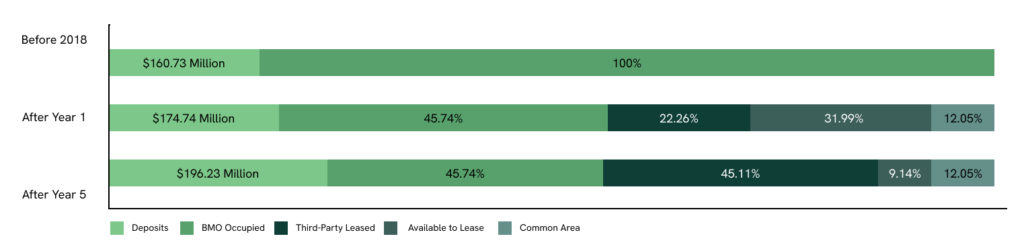

- Before 2018, deposits = $160.73 million and 100% occupied by BMO

- After 1 year: deposits = $174.74 million, 45.74% of building occupied by BMO, 22.26% leased by third parties, including non-profit YMCA, 31.99% available for lease and 12.05% common area

- After 5 years: deposits = $196.23 million (increase of 22.09%), 45.74% of building occupied by BMO, 45.11% leased by third parties, including non-profits YMCA and United Way, trucking company West Bend Transit and 9.14% available for lease and 12.05% common area